The U.S. office market displayed a nuanced landscape in the first quarter of 2024, as observed through analyses by JLL, Moody’s Analytics, and Commercial Edge. Despite macroeconomic improvements and rising demand, negative net absorption persisted, driven by significant space reductions from major occupiers, according to JLL. However, this downsizing trend was offset by a robust and growing conversion and redevelopment pipeline that took space off the market, contributing to the rebalancing efforts.

JLL noted a gradual rise in vacancies, yet emphasized many companies’ continued commitment to office spaces, citing the significance of physical presence for fostering culture and collaboration. However, this commitment contrasted with shifting demand dynamics, as sleek office towers in U.S. downtown developments attracted tenants away from older buildings, according to the analysis.

Meanwhile, uncertainties surrounding lease renewals and variable interest rates complicated predictions regarding vacancy peaks, as highlighted by JLL’s report. The office sector reached a new vacancy record, surpassing historic peaks observed in 1986 and 1991, with effective rents experiencing a marginal decline despite slight increases in asking rents, according to JLL.

Office Performance in Tertiary vs. Primary Markets

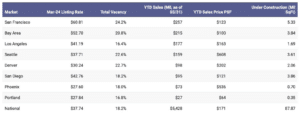

Primary markets, such as San Francisco and the Bay Area, experienced significant increases in vacancy rates, indicating a higher level of market activity and potentially more available office space. In contrast, tertiary markets like Detroit and Minneapolis had relatively high vacancy rates but did not see the same level of sales volume compared to primary markets, as highlighted by Commercial Edge.

San Francisco and the Bay Area are known for being hubs for technology companies, as indicated by the substantial increases in vacancy rates in these regions. This concentration of tech companies can drive demand for office space but also contribute to fluctuations in vacancy rates. Tertiary markets may have a lower concentration of tech companies, leading to different demand dynamics, according to Moody’s Analytics.

Additionally, primary markets typically see higher sales volumes, as demonstrated by the larger sales figures in regions like the Bay Area, San Diego, and Phoenix. These markets attract more investment and attention from buyers and sellers due to factors such as economic growth, industry presence, and overall market stability. Tertiary markets may experience slower sales activity, reflecting less investor interest or a smaller pool of available properties.

Overall, primary markets exhibit greater activity, higher demand, and stronger economic fundamentals compared to tertiary markets in the U.S. office sector. By staying in the loop about these market trends, investors can adapt their investment strategies, capitalize on emerging opportunities, and navigate potential risks more effectively in the dynamic landscape of the U.S. office sector.

A Trusted Guide in Commercial Real Estate

Coldwell Banker Commercial® provides Commercial Real Estate Services from Property Sales and Leases, to Property Management. Learn how our expansive network of Independently Owned and Operated Affiliates and Real Estate Professionals use their in-depth knowledge of the local market and industry trends to help businesses and investors navigate the complexities of the commercial real estate landscape.