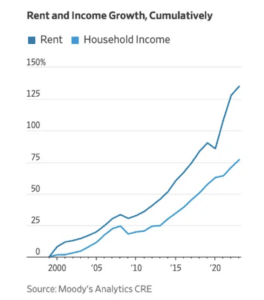

The U.S. is facing a potential loss of nearly 200,000 affordable housing units in the next five years as government protections expire for hundreds of rental properties, allowing landlords to set their own rents, highlighted by The Wall Street Journal. The main program used by the federal government to encourage developers to build affordable housing is a 30-year tax credit. However, specific agreements that assisted low-income renters are set to end, giving landlords the option to charge market rates for their units instead of continuing with the government program. Due to a period of high rent growth, many landlords are expected to raise rents significantly. Between early 2021 and the summer of 2022, asking rents for market-rate units increased by 25%, according to Apartment List, a rentals website. By 2027, up to 188,000 low-cost rental apartments funded by the government tax credit could convert to market rate, as reported by Moody’s Analytics.

Certain cities, such as Dallas, Chicago, and Houston, are at risk of losing a significant portion of their affordable housing. During the pandemic, a considerable number of affordable housing units vanished, with a decline of 400,000 apartments and rental homes for families in poverty between 2019 and 2021, according to the National Low Income Housing Coalition, which analyzed U.S. census data. Some of this loss was attributed to the expiration of tax credits, as mentioned by Moody’s Analytics.

Without longer affordability agreements or new subsidies, approximately 100,000 units of tax-credit housing could expire annually by 2033, according to Peter Lawrence, director of public policy and government. Rent increases following expiration can be substantial, as affordable housing rents are typically 38% below market rates on average, but after expiration, they rise to about the same level as market-rate properties of comparable quality and location, according to a study by Freddie Mac.

This situation has left some long-term renters in difficult situations. The Wall Street Journal article shares the story of an 85-year-old renter in California who lives on a monthly income of $1,000 and has experienced minimal rent increases for nearly three decades. However, in 2021, the landlord opted out of the federal tax credit program, causing the rent to more than double, going up to as much as $1,300. Landlords have been major supporters of the tax credit program, and many have built large businesses by operating affordable housing. But without new subsidies or incentives, building owners will likely take advantage of the recent hot market and raise rents to meet the rising costs of maintenance, insurance, and property taxes.

The solutions to this looming challenge will require cities and government agencies to work with landlords and developers to encourage investment into affordable housing projects, while simultaneously creating the incentives to do so. It is a complex situation that won’t easily be solved but without collaboration to address the need, it is clear that fewer options will be available. That doesn’t bode well for the future of many who are in desperate need and could end up without a safe and secure place to live.