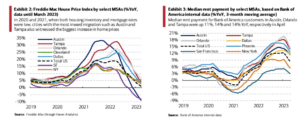

Estimates of domestic migration patterns over the past year underscore the enduring impact of pandemic-driven relocations. In fact, Bank of America data suggests that cities that saw a large influx of people during the pandemic have still been growing faster than other cities in recent quarters. The ongoing trend reveals a notable surge in population migration towards Sunbelt cities, prominently Austin and Tampa. Interestingly, the data points towards a younger demographic choosing Austin, which could potentially amplify rent prices while having a muted effect on home prices. This divergence can be attributed, in part, to the broader lack of affordable housing in many markets, prompting younger prospective buyers to defer homeownership and opt for rentals, thereby reinforcing the rental market’s strength in Austin.

Furthermore, local housing markets boasting substantial populations of both Millennials and Baby Boomers may find themselves on solid footing. The Baby Boomers, well into their prime home-buying age, and the Millennials, often seeking different housing solutions, are set to influence demand in their respective ways. Downsizing and post-retirement relocation among Baby Boomers will contribute to the dynamics of these markets.

Bank of America’s Housing Morsel data offers intriguing insights into popular destinations amongst Baby Boomers and Millennials. For instance, Baby Boomers appear drawn to destinations like Las Vegas and Tampa, while Austin remains the preferred choice for Millennials. An interesting trend emerges as both generations leave larger urban centers, such as San Francisco and New York.

These migration trends have significant implications for the commercial real estate sector. The continued population influx into Sunbelt cities, particularly among younger demographics, indicates that these regions are poised for increased demand in various CRE segments, such as retail, multifamily, and office spaces. This shift towards rentals in response to housing affordability challenges suggests that the rental market in these areas is likely to remain robust, offering opportunities for CRE investors. Furthermore, local markets with a substantial presence of both Millennials and Baby Boomers present a unique opportunity for CRE stakeholders to cater to diverse housing needs, from multifamily developments for younger generations to senior housing options and downsizing solutions for Baby Boomers. Understanding the specific preferences and demands of these demographic groups will be crucial for CRE professionals looking to navigate and thrive in these evolving markets.

In essence, these migration trends bring several notable implications for the real estate market, emphasizing the importance of understanding evolving demographics and preferences. Investors and developers should remain vigilant to capitalize on emerging opportunities in these dynamic landscapes.

A Trusted Guide in Commercial Real Estate

Coldwell Banker Commercial® provides Commercial Real Estate Services from Property Sales and Leases, to Property Management. Learn how our expansive network of Independently Owned and Operated Affiliates and Real Estate Professionals use their in-depth knowledge of the local market and industry trends to help businesses and investors navigate the complexities of the commercial real estate landscape.