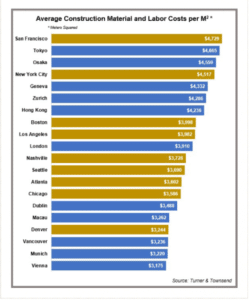

Despite global market volatility and a variety of challenges in the industry, construction activity still continues to increase across multiple markets. Some of these challenges include universal inflationary trends founded on construction labor shortages, demand exceeding supply, and disruption in supply chains hitting costs and programs. According to Turner & Townsend’s 2022 International Construction Market Survey, when it comes to increasing construction costs—including labor and materials costs—the United States dominates rankings of the most expensive places in the world for real estate development.

As stated in Turner & Townsend’s market survey, San Francisco currently ranks as the world’s most expensive market for construction, at $4,729 per square foot. John Robbins, Turner & Townsend’s Managing Director for the U.S. and North American Head of Real Estate explained, “In San Francisco, construction demand is continuing to be led by increasing requirements for new mixed-use real estate from Google, Apple, Facebook and other tech companies throughout the Bay Area.”

Meanwhile, on the east coast, New York is also ramping up demand for new apartment buildings and zero-carbon retrofits on existing buildings. “A common feature across both cities is the greater competition they face to retain skilled labor,” Robbins said.

Why does it cost so much to build in the US compared to other countries?

Turner & Townsend analysts suggest that a stronger U.S. dollar, combined with supply chain disruptions (leading to more expensive materials) and increasing labor expenditures are why it costs more to build in the United States. As you can see on the chart above, Tokyo and Osaka ranked second and third for the most expensive places for real estate development, while New York ranked fourth, Boston ranked eighth, and Los Angeles ranked ninth place. Overall, nine U.S. markets placed in the top 20 when it came to construction costs.

Turner & Townsend’s market survey also explained that due to a combination of cost drivers – including rising energy costs, materials shortages and labor availability – along with high sector-specific demand, particularly residential and industrial, markets in North America and many European cities recorded double-digit cost increases. As a result, American cities moved significantly up the ranking. This upward trend is being propelled forward by the U.S. dollar appreciating (on average) by 5% against most currencies.

High Costs in Japan

Tokyo ranked 2nd among the most expensive places to develop real estate in the world. According to Bloomberg, the price of new apartments in Tokyo toppled a 30-year-old record in 2021 as rising demand from dual-income households and increasing construction costs boosted the Japanese capital’s once-moribund housing market. Additionally, with a shortage of land and high construction costs, supply is not likely to jump anytime soon. Taking demand into consideration as well, it’s highly unlikely that prices will fall in Tokyo.

Developers eyeing new projects in the U.S. are wise to consider how various factors impact their ability to build a project. There are a range of options – including in major, secondary and tertiary MSAs – in which market fundamentals, jobs, demand and growth projections still make sense even when faced with challenges such as inflationary conditions. Applying sound analytics and market research by a local market commercial real estate expert can reveal which local markets are primed for construction activity.